Corporate Finance

Over the last three years, Eduvisors has provided objective and independent support to clients on over 10 transactions in Education sector in India.

Transactions have become increasingly become important to our clients, who face changing regulatory environments, globalization, the blurring of boundaries between formal and non-formal education, and cost pressures. Managing the complexity of transactions can be challenging for even the most experienced education leaders. Eduvisors plays a critical role supporting all phases of transactions-before, during, and after-to ensure that the deals are in line with corporate strategy and achieve maximum value. We work closely with clients to build their capabilities towards assessing opportunities and managing transactions.

At Eduvisors we confront each challenge sans any preconceived notion; our solutions are based on facts rather than opinions.

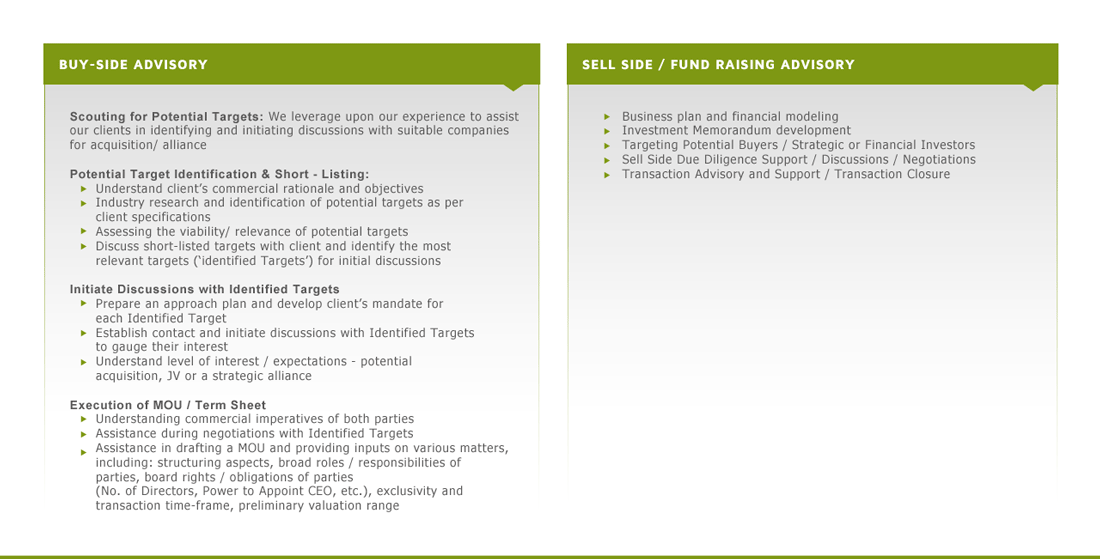

Being a leading sector-focused consulting firm, Eduvisors has the most extensive network of relevant buyers and sellers in Education. Our Transaction Advisory acts as lead advisors and project managers for providing end-to-end solution for both, buy-side and sell-side transactions. We assist in the transaction from transaction strategy formulation through closure and in addition provide post-transaction support and integration services. Our team also provides specialised lender services and valuation services on stand-alone basis.

Buyer Services

The buyer services team supports the client in every stage of the buying process. Our experts perform comprehensive due diligence, including quality of earnings, synergy analysis and evaluation of financial and non-financial projections. We help assess key value drivers and risk factors. We also advise clients on the most advantageous tax and accounting structures and oversee the contract and valuation processes.

Seller Services

We support clients on the seller side to help them manage the sales process, increase the probability of a successful sale and realize maximum value at the time of the transaction. Our team assumes responsibility to:

- Provide vendor due-diligence to minimize risk and make the sale process smoother

- Evaluate entities for sale, including quality of earnings, balance sheet & working capital requirements

- Identify value enhancers and value issues

- Negotiate with buyers on the client’s behalf – independently or as a team

- Prepare offering memorandum

- Managing the due-diligence process

Lender Services

We advise clients on all aspects of the lending decision-making process, for both domestic and foreign-based opportunities The services provided by us include:

Review and sensitize financial and non-financial business plan projections

Carry out due diligence, analyze collateral and monitor portfolios

Assist in scenarios of credit-crisis and recommend credit restructuring alternatives

Support securitizations and provide backup management services

Valuation

Optimal valuation is the cornerstone of any successful transaction. Achieving a reliable valuation of a business or asset is the critical driver of a successful transaction for buyers, sellers and potential alliances. Valuations of entities in Education with a complex structure of private limited ‘management services’ companies and not-for-profit trusts or societies or Section 8 companies is a critical skill that Eduvisors as an expert brings in Education sector acquisitions, JVs and alliances in India.

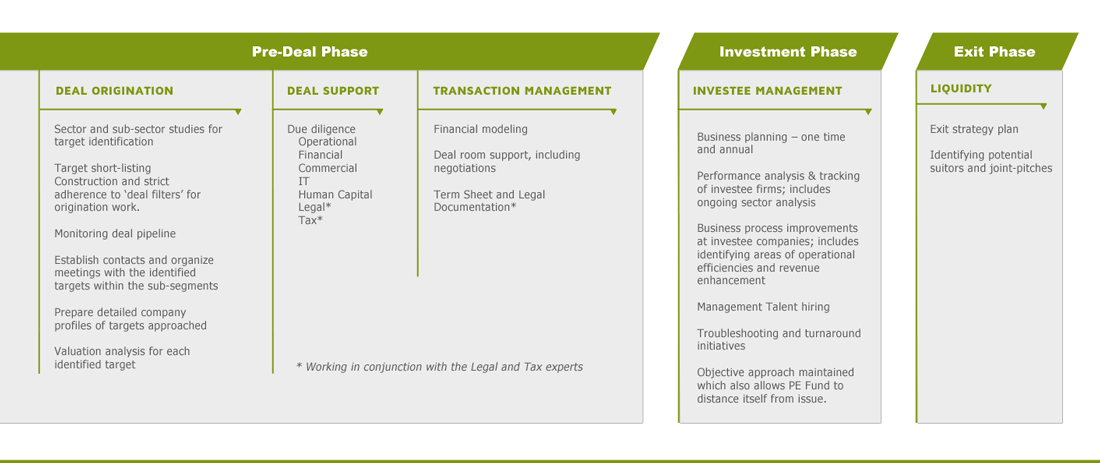

To execute deals quickly and effectively, private equity firms need immediate access to experienced resources, but their lean business models mean that they need to work with professional advisors like Eduvisors who have a deep understanding of the sector and are part of the business network, which helps in efficient sourcing of deals.

- Private equity firms are always on the lookout for the right opportunities, and these are increasingly global. Hence, cross-border capability and presence is essential for successful deal-making.

- We work closely with several clients in private equity helping them make acquisitions and advising them on their investment exits.

- Our global reach, through Barry & Stone network, means that we can provide resources on-the-ground wherever they are required. The breadth and depth of our relationships allows us to spot opportunities for private equity investment relatively faster and smarter.

We are the leading Education sector focused private equity advisors in India with strong relationships with all major equity houses and capability to advise on all aspects of private equity transactions from deal origination, through structuring to exit planning and execution.

Achieving a optimal valuation of a business or asset is the most crucial aspect of a successful transaction for buyers, sellers and potential alliances. Valuations of entities in Education with a complex structure of private limited ‘management services’ companies and not-for-profit trusts or societies or section 25 companies is a critical skill that Eduvisors as an expert brings in Education sector acquisitions, JVs and alliances in India. We assist our clients with valuations either on a stand-alone engagement basis or as a part of a larger transaction engagement.

- Valuing the combined entity or the for-profit part of a education business in private Education requires deep understanding and analysis of a variety of regulatory factors specific to the sub-segment – K-12, HigherEd or Vocational Skills. These include both detailed technical knowledge of value drivers and in-depth industry knowledge.

- In the event of a merger, acquisition or alliance, it is vital to understand the value likely to be created through the transaction.

- The decision to restructure all or part of a business needs to be guided by a comprehensive understanding of the services that can exist in for-profit and in not-for profit entities.

- In the event of a dispute, an independent valuation is likely to help resolve issues efficiently.

- Operating globally through the Barry & Stone network means that an understanding of the issues driving valuations in different countries is essential. Applying a common methodology across all countries generates a more reliable view of an international business’s value.

Our valuation experts assist our clients in obtaining an in-depth understanding of the value of each business or asset in a transaction. Our leading-edge technical knowledge combined with our in-depth industry knowledge allows us to understand the specific factors driving each individual transaction.

Smart investors recognise that successful transactions only start with a comprehensive understanding of the business and not just the financial statements. Importance of operational due-diligence in Education sector transactions in India becomes even more critical due to the regulatory quagmire between for- and not-for entities, associated real estate, long-term leases, approvals and affiliations.

Eduvisors Operational Due Diligence team assists our clients in analyzing functional and departmental processes, regulatory framework, complex structuring and long-term contracts. From our rigorous fact-based analysis, we identify and quantify potential EBITDA adjustments and working capital related risks and opportunities. Our integrated teams work seamlessly on operational and financial due-diligences to develop a holistic view of the transaction opportunity.

Our Operational Due-Diligence services include a review of the following aspects:

- Business plan

- Operational and financial modeling

- Strategy

- Structuring

- Regulatory framework

- Information technology

- Human resources

- Student acquisition processes and challenges

- Alliance/partnership arrangements

We believe any transaction ‘starts at the completion’ as the benefits and value that the deal was designed to deliver need to be realised from the point the deal was closed. More so in Education sector, where deals often fail to deliver the value forecast for them and this can be for a variety of reasons – one of them being complex for-profit and not-for-profit structures and associated regulatory approvals and affiliations. Often part of the reason lies in the lack of integration between the for-profit and not-for-profit entities and its newly-acquired asset.

- A transaction represents a significant change to the business, and one that requires careful management if the anticipated benefits are to be turned on quickly.

- Eduvisors has extensive experience of helping education businesses integrate new acquisitions, both in Trusts/Societies or private limited companies. Our teams comprise many experts with experience in managing education entities in this complex structure environment.

- We have developed specific tools and processes that have proved their worth in multiple transactions. Their early application saves significant time and money.

- Our teams of experts work on-site to help manage the changes that a deal generates in an existing business.

- We address the concerns of the acquirer over the first 100 days of the acquisition and produce detailed action plans to deliver value from the deal.

- We also carry out post-deal reviews after 6 to 12 months to ascertain whether goals are being met and if not, how to get them back on track.

- Our knowledge of HR issues, specific to Education institutions allows us to give practical advice on employee management. As a result, we help our clients to navigate through the wide variety of employee programmes used and to help them choose the best programmes to achieve all potential synergies

Client: VC Fund (Investee Management)

Project Scope: Post deal services. Growth strategy and implementation for the investee company

Outcome: Executed in two phases, the 1st phase of the assignment involved assisting our client’s investee, a K-12 School chain, with a national go-to-market strategy. The plan considered the demand, supply and the regulatory constraints of the business for a variety of geographies, outside the State in which it operates. Subsequently, we were given the mandate to work closely with the leadership team of the investee company to work on the implementation of the plan with respect to expanding to new geographies and forging relevant alliances.

Client: Private Equity Fund.

Project Scope: Early stage presence in India; virtual office.

Outcome: We set-up a team on behalf of an international PE fund that was interested to invest in Education sector in India. Since our client it was not sure of the quantum and quality of opportunity in Indian education sector, Eduvisors assisted in mitigating the start-up risk for the fund. Our team acted as a virtual office for them and provided them with weekly updates on the opportunities and generated pipeline for a period of 12 months.

Client: A leading global publishing house.

Project Scope: Acquisition of complementary businesses in online Education space in India

Outcome: We got the mandate to acquire a company of reasonable size in a domain that was complementary to that of our client’s. We were able to successfully identify and approach relevant set of target companies and closed the acquisition end-to-end.

Client: Testing & Assessments.

Project Scope: Strategic sale; sell-side advisory

Outcome: Our mandate was to sell the Testing & Assessments division of our client’s business that was non-strategic to them. We approached strategic buyers based on the criteria identified by the client, negotiated, structured and concluded the asset transfer in less than 3 months.

Do you have questions about how Eduvisors can help ? Send us an email and we’ll get in touch shortly.